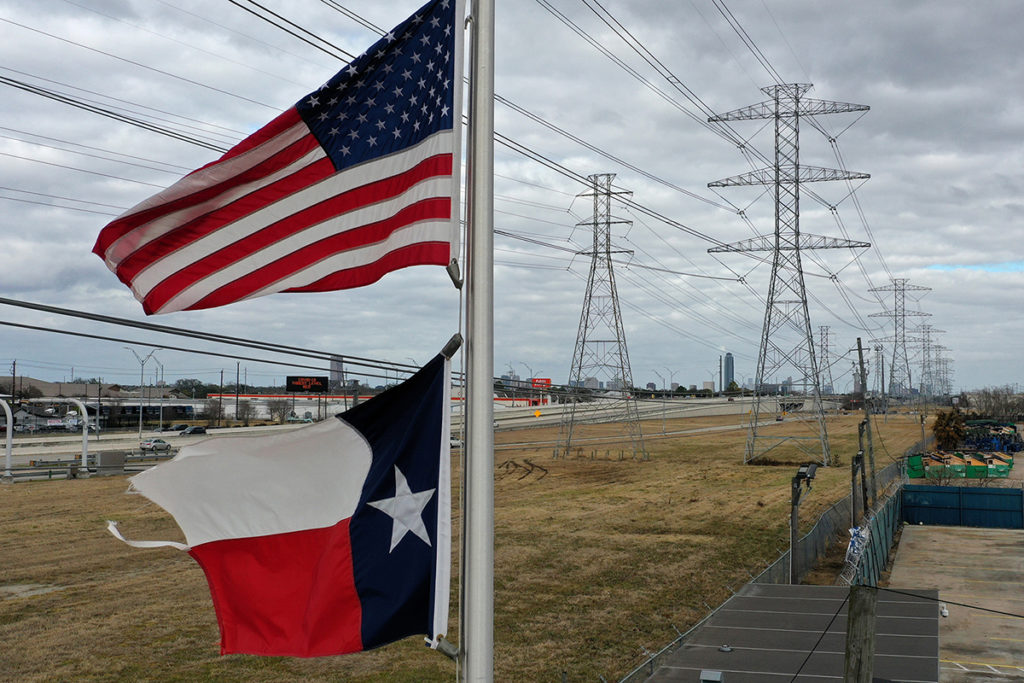

More than two dozen utility executives, including leaders of two electric cooperatives, testified at two marathon hearings in the Texas legislature last week to examine what went wrong during a February cold snap that paralyzed the state’s electric grid and left millions without power for days.

Residents of hundreds of Texas communities are still struggling to recover two weeks after one of the longest and most widespread power outages in the state’s history, and lawmakers are demanding assurances that the problems never happen again.

“This is the largest train wreck in the history of deregulated electricity,” said state Sen. Brandon Creighton of Conroe.

During the Feb. 13-19 event, Texas’ electric grid was impaired by the loss of generation from wind and solar energy, coal, natural gas and nuclear sources. Just under half of the state’s electric generation sources were offline at one point during the week.

“When you lose almost half your generation, you are going to have a problem,” Bill Magness, president and CEO of the Electric Reliability Council of Texas, told a state Senate committee last Thursday.

ERCOT is the grid operator overseeing the generation and transmission assets of dozens of utilities in the state, including electric co-ops. Collectively, those utilities serve 26 million Texans in 70% of the state’s territory. Of the 620 generation units on the ERCOT system, at least 185 reported problems.

A combination of ice storms, subfreezing temperatures, mechanical failures, fuel challenges, stakeholder miscommunications and unprecedented demand compromised grid stability and left 4 million consumers without power. Had demand been allowed to outpace the available generation, damage to power plants, substations and other assets would have been extensive.

“We never want to black out the system, so that’s the problem, and there’s nobody that wants to solve it more than me,” Magness said Feb. 25 during a grueling and often contentious 10-hour committee hearing.

During the emergency, ERCOT called on transmission operators to implement controlled outages to prevent catastrophic failures.

“Even though we had sufficient generation to meet the needs of our members, we had to shed load like any other transmission provider,” said Mike Kezar, CEO of South Texas Electric Cooperative, a G&T owned by eight distribution co-ops.

STEC’s five power plants, two wind farms and a pair of hydroelectric facilities, owned or under contract, performed well throughout the emergency, he said. But the G&T’s transmission was still subject to ERCOT-ordered cyclical power interruptions, which averaged 3.5 hours each.

The loss of generation, particularly from natural gas pipeline failures and curtailments of industrial generation sources, prompted ERCOT to activate a $9,000-per-megawatt-hour price cap mandated by the Texas Public Utility Commission. The typical cost of power on the ERCOT grid is around $26 per MWh.

Similar control measures have been used previously for short periods of time to help manage peak summer demand costs, but extended application of the capped rate is unprecedented.

A $2.1 billion February power bill forced Waco-based Brazos Electric Power Cooperative to file Chapter 11 bankruptcy on March 1, citing the need to insulate its 16 distribution co-ops and their members from “unaffordable electric bills,” said CEO Clifton Karnei in a statement.

“This court-supervised process will provide us with the protections and mechanism to protect and preserve our assets and operations and satisfy obligations to our creditors,” he said.

Amarillo-based Golden Spread Electric Cooperative belongs to both ERCOT and the Southwest Power Pool and saw costs balloon in both power markets during the cold weather event.

“Estimates are that the power bill for the month of February 2021 will exceed the cost of power paid in previous years,” said D’Ann Allen, the G&T’s manager of member relations. “Whatever Golden Spread’s share of that expense is will be high and, unfortunately, borne by our members.”

Allen said the co-op is working with its board to determine how to soften the blow for member co-ops. “More than likely, it will take years,” she said.

Some Texas co-ops are adopting measures to ease the impact on consumers, including suspending late fees and disconnects for non-payment, relaxing deposit requirements, offering deferred payment plans and delaying planned electricity rate changes that were scheduled to go into effect this spring.

Derrill Holly is a staff writer at NRECA.