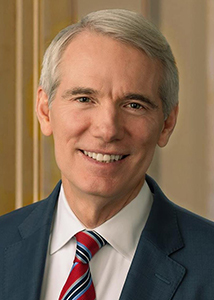

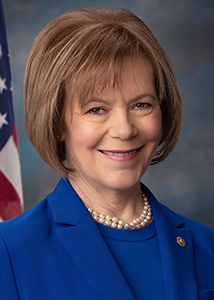

More than a third of senators have now signed on to support the RURAL Act, a bipartisan bill by Sens. Rob Portman, R-Ohio, and Tina Smith, D-Minn., to protect electric cooperatives’ tax-exempt status.

As of Monday, 38 senators were co-sponsoring the bill, which would allow not-for-profit co-ops to accept government grants for disaster relief, broadband service and other priorities without losing their tax-exempt status.

In the House, 269 members have signed on to the bill, led by Reps. Terri Sewell, D-Ala., and Adrian Smith, R-Neb.

The RURAL Act would fix a problem created by the 2017 Tax Cuts and Jobs Act, which began counting grants as non-member income for co-ops. Under federal law, co-ops must receive at least 85% of their income from consumer-members to remain tax-exempt. Before the law took effect in 2018, grants were considered capital and did not affect co-ops’ tax status.

Unless Congress passes the RURAL Act, co-ops may be forced to pay the new tax by raising rates for their consumer-members, many of whom live in high-poverty areas.

The Joint Committee on Taxation estimated last week that the bill would cost the U.S. Treasury $3.4 million a year in lost taxes for 10 years—a tiny amount for a federal budget that is nearly $5 trillion.

Portman and Smith talked about their strategy for passing the bill and explained why it’s important to rural Americans.

What are the biggest challenges/obstacles to getting the bill passed in the Senate this year?

Portman: To be honest, the biggest challenge we face is whether the Senate will be able to work with the House to pass any significant tax legislation this year. This is especially true for any legislation building upon the monumental tax reform of 2017. While the RURAL Act actually goes beyond their pre-tax reform treatment by simplifying the treatment of governmental grants and assistance received by co-ops, this bipartisan legislation is still getting caught up in the partisan politics of tax reform. Ultimately, I am optimistic that the strong bipartisan nature of this legislation will help clear the path through the partisan discussions around tax policy in Congress today.

Smith: Passing legislation in today’s polarized political climate is never easy. There are several bills to correct problems with the 2017 Republican tax bill that have been caught up in negotiations over other tax measures. However, I’m hopeful that we can now make meaningful progress toward an agreement that addresses the problems with the 2017 tax bill and some of the corrections and other middle-class tax relief provisions that should have been included in that bill.

The House now has more than a majority of its members signed on as co-sponsors of the bill. If the House can pass the RURAL Act with a strong bipartisan majority, would that help you convince a majority of senators to take up and pass the bill?

Portman: We also have significant support in the Senate…more than a third of the Senate. But yes, a strong bipartisan majority, and hopefully an even stronger bipartisan vote in the House, would provide a clear signal to my colleagues that the RURAL Act is a common-sense fix to the tax code.

Smith: We have a strong bipartisan coalition in the Senate and with stakeholders across the nation. We’re pushing to get this across the finish line as soon as we can, but to do so, senators will need to continue to hear from their constituents about this bill.

What do you see as the best strategy to pass it?

Portman: As much as I think that the widespread bipartisan support in both the House and Senate make a strong argument for passing the RURAL Act on a standalone basis, Congress very rarely passes standalone tax bills. It’s most likely that this bill becomes part of a broader tax package that rides along with a must-pass piece of legislation, hopefully in the coming months.

Smith: I believe that the most important thing to getting this bill passed is to make sure that senators and members of Congress hear from their constituents about why this issue is so important. When you make your voices heard, you have an incredible ability to effect the kinds of changes you seek.

What do you think are the most effective arguments you have when you’re asking other senators to co-sponsor the bill or when you’re asking leadership to bring it to the floor?

Portman: There are few issues that unite my colleagues more than expanding access to rural broadband. No matter what part of the country you’re from, there’s a good chance that parts of your state wouldn’t have access to high-speed, reliable internet without the services provided by tax-exempt rural co-ops. Any legislation that ensures co-ops will continue expanding these broadband services should be an easy bill for my Senate colleagues to support.

Smith: Most of my colleagues I speak with understand just how vital rural electric cooperatives are to rural communities…For many decades, this tax-exempt business model has ensured that hundreds of Minnesota rural communities—and thousands across the country—have affordable, reliable power and the significant economic benefits that come with it. It wasn’t the intent of the 2017 tax law change to jeopardize rural electric cooperatives’ tax-exempt status.

How will your rural constituents be hurt if their co-ops lose their tax-exempt status?

Portman: The Ohio electric co-ops provide electricity and broadband services to more than 380,000 of my constituents, covering 77 of Ohio’s 88 counties and some of the most rural areas of the state. If just one of these co-ops were to lose their tax-exempt status, the Ohioans they serve would almost immediately feel the squeeze as the co-op would be forced to raise their rates in order to afford the new tax payments. For a lot of families and individuals in the rural areas of my state, even a small increase in the cost of necessities such as electricity and broadband could make a world of difference in their financial security. We can’t let that happen, which is why Congress should pass the RURAL Act as soon as possible.

Smith: Many cooperatives in Minnesota and across the country are in danger of being forced to choose between keeping their tax exemptions and accepting an important grant to clean up a disaster or to expand broadband services. The resulting costs to cooperatives could force up electricity rates for customers and make cooperatives think twice about accepting grants that could help their communities.

How can co-op leaders and members in your state and throughout the nation best help you pass the legislation?

Portman: As far as Ohio goes, I’m very pleased with the grassroots effort by the Ohio co-ops to encourage the delegation to support the bill. Last I checked, there’s only one more House member out of 16 that hasn’t co-sponsored, and I’m hopeful [Sen. Sherrod] Brown will support the bill as well. Even outside of Ohio, I have to say I’m very impressed by the grassroots effort across the board…

But you shouldn’t take that as a sign to let up, either. Whether it’s in Ohio or any other state, it is crucial that everyone continue to reach out to their representative or senator to talk about the importance of the bill and the potential consequences of a co-op losing its tax-exempt status. With your help, I’m confident that we can continue growing support for the bill and have a chance at passing it this year.

Smith: You should make your voices heard by your representatives in Washington. Senators and members of Congress care deeply about what’s important to their constituents, and I’m hopeful that you will be able to play a key role in getting them to accept a tax package that addresses this problem and the other key tax priorities that Congress needs to address. As we come to the end of the tax year, I plan to make it clear to my colleagues that we can’t continue to allow our tax laws to hinder our nation’s electric cooperatives from doing the important work of powering our rural communities and supporting jobs and economic development. I’ll be pressing [Senate Majority Leader Mitch] McConnell to reach a fair agreement that allows this bill and other important tax priorities to be addressed.

Read more coverage of the RURAL Act:

RURAL Act: Why Popular, Bipartisan Legislation Can Face Hurdles in Congress

As Majority of House Signs On to RURAL Act, Lead Sponsors Press for Vote

Co-op Voices, Part 1: How Losing Tax-Exempt Status Would Hurt Rural Residents

Co-op Voices, Part 2: CEOs Discuss Impacts of Tax Law Glitch for Members

Q&A: RURAL Act’s Lead House Sponsors Say Co-op Voices Are Key to Bill’s Success

Co-op CEO to Congress: Help Expand Rural Broadband by Passing RURAL Act

NRECA CEO Jim Matheson: ‘If We All Stand Up,’ Co-ops Can Save Tax-Exempt Status

Co-op Advocacy Needed to Move Vital Tax Fix in Congress

Bipartisan Bill Would Protect Co-ops From Losing Tax-Exempt Status

Listen to a recent podcast on the RURAL Act:

Erin Kelly is a staff writer at NRECA.