NRECA and member co-ops are gearing up to press the new Congress and incoming Biden administration to support legislation that could save electric cooperatives more than $10 billion by allowing them to reprice Rural Utilities Service loans at current low interest rates.

The bill was not included in a year-end package passed in December by the last Congress. However, the Flexible Financing for Rural America Act has strong bipartisan support and is expected to be reintroduced in the 117th Congress. It could become part of a larger COVID-19 relief package that President-elect Joe Biden is urging lawmakers to pass early this year.

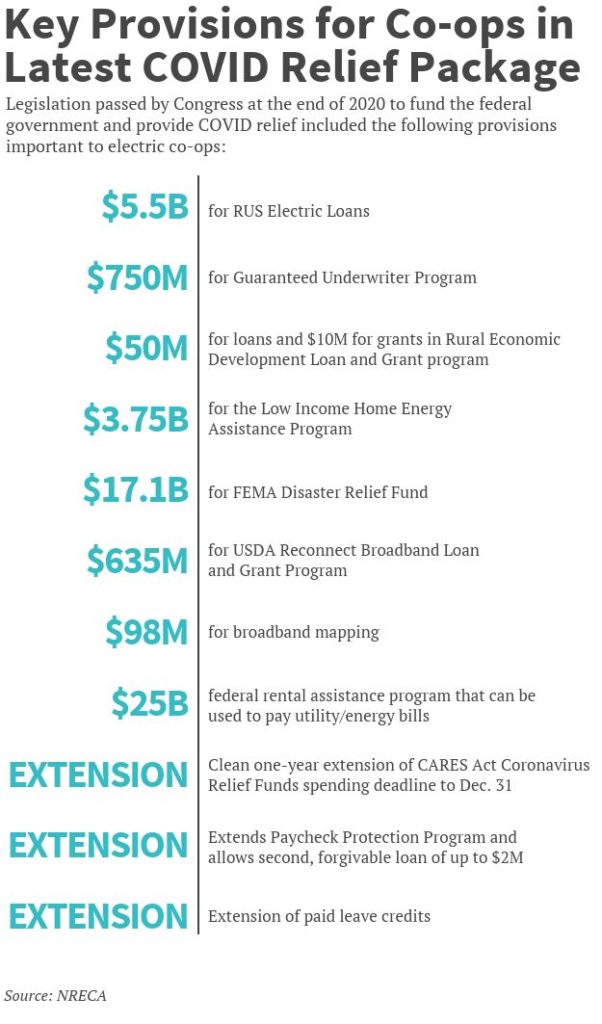

Although the previous Congress did not take up the RUS bill, lawmakers passed several spending provisions that benefit co-ops and their consumer-members, including $5.5 billion for RUS electric loans, nearly $4 billion for the Low-Income Home Energy Assistance Program that helps struggling families, and $25 billion in rental assistance that renters can use to pay their utility bills.

Congress also approved more than $17 billion for the Federal Emergency Management Agency Disaster Relief Fund and $635 million for the U.S. Department of Agriculture’s ReConnect Loan and Grant Program, which helps fund broadband deployment in rural America. Lawmakers also extended the Paycheck Protection Program, which provides forgivable loans to co-ops and other small businesses to keep employees working during the pandemic.

NRECA will continue to advocate for the RUS refinancing bill, which would provide a much-needed boost to co-ops hit hard by the COVID-19 pandemic. The pandemic has reduced demand for electricity from many commercial and industrial co-op members struggling to survive, including oil companies, agricultural producers and businesses that depend on tourism.

Some residential consumer-members have been unable to pay their electric bills amid job losses and other financial hardships. NRECA economists have estimated that co-ops could lose up to $10 billion in revenue through 2022 as a result of the pandemic.

“Our message to Congress is that we simply want to act like other businesses across America and be able to refinance debt without penalty,” said NRECA CEO Jim Matheson. “It would be significant for the financial stability of electric co-ops right now, but it’s also important in the long term for the resurgence of the economy in rural America.”

The proposed legislation would allow co-ops to request rate adjustments on their existing RUS loans from the USDA within 180 days of the bill’s enactment. It would waive any prepayment penalties normally associated with RUS refinancing. The new interest rate available to co-ops would be the U.S. Treasury rate that most closely matches the remaining term on the loan being repriced.

Based on current interest rates, NRECA estimates that co-ops could realize a net savings of $10.1 billion from repricing $42 billion of direct and guaranteed RUS loans held by about 500 co-ops. An average co-op with typical RUS debt could save $2 million a year in interest payments if they could take advantage of today’s rates.

Erin Kelly is a staff writer at NRECA.