Sultry summer nights were anything but comfortable for Rev. Michael Yates, his wife and two teenage daughters. The family was sticky and restless inside its Camp, Arkansas, home.

“We were just using fans,” said Yates in mid-July. “Inside, the house temperatures were between 80 and 85 degrees. We were sleeping on top of the covers with fans blowing over us and it was hot.”

Replacing a broken compressor on his aging central air unit would have cost Yates $2,000. With the heat of August looming, he turned to North Arkansas Electric Cooperative for help through its Energy Efficiency and Conservation Loan Program (EECLP).

Since 2015, the Salem, Arkansas-based co-op has loaned members more than $1 million through the program to finance approved energy-efficiency projects, including insulation, new windows and energy efficient heat pumps and lighting.

“We loan the money directly to members,” said Mel Coleman, CEO of NAEC, adding that in 2017, he expects overall loan volume to surpass the $2 million mark. “It’s one of the most beneficial programs our co-op has ever been able to offer members.”

Since its launch in fiscal 2015, the program, which is administered by the USDA’s Department of Agriculture’s Rural Utilities Service, has obligated $124 million in loans. It has proven popular with electric co-ops promoting energy efficiency among their members.

“Co-op and community-tailored energy-efficiency initiatives are going to be more successful than top-down solutions from Washington, D.C.,” said Chris McLean, acting RUS administrator. “Community-based service providers are well positioned to identify the solutions that their members and customers need.”

According to McLean, North Arkansas Electric Co-op was among the earliest electric cooperatives participating in the program. As an example of its success, he cited use of NAEC’s loan application documents as models for other co-ops considering development of similar loan programs.

“I see interest growing because from a cooperative point of view, being able to manage and shape demand provides opportunities for membership to improve affordability of power for consumers,” McLean added.

Loan default rates for the program are generally less than 1 percent, and the projects recommended for financing are supported by assessments from trained co-op energy advisers.

Officials at USDA have cited work with staff at NAEC and Aulander, North Carolina-based Roanoke Electric Cooperative for simplifying the loan process and improving the administrative efficiency of the program.

“The wise and efficient use of energy saves our members money,” said Coleman. “That gives them a better quality of life, more comfort in their homes and more spending money in their pockets.”

North Arkansas Electric Cooperative has been loaning money to members to pursue energy efficiency since the 1980s. Through the current USDA program and its predecessor, the co-op has loaned more than $15 million to members, who repay the loans in a seven- to 10-year period.

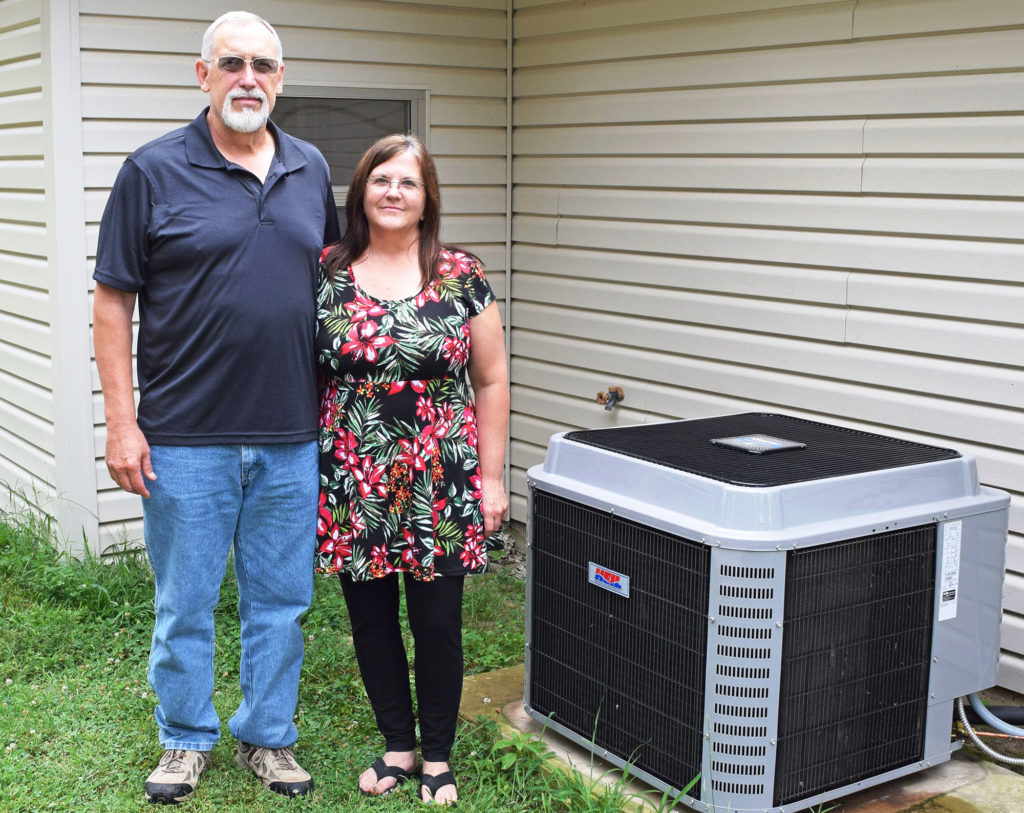

A new high-efficiency heat pump, installed less than a week after Yates filled out the co-op’s EECLP application, works better than the balky air conditioner it replaced.

“It’s been a little cold in the house, and we have the thermostat set on 74 degrees,” said Yates.

While he has not received the first bill since the new unit’s installation, Yates said he’s pleased with the financing he got through the co-op program.

“I would have paid a higher interest rate through a bank and likely would not have gotten as many months to pay off the loan,” Yates said. “A lot of people don’t have $5,000 to $7,000 in the bank they can spend to handle emergencies like this.”

Derrill Holly is a staff writer for NRECA