No one in the tiny town of Limon, Colorado, thought John Rohr was a wealthy man.

He was general manager of the electric cooperative, but he drove an old car without air conditioning. He shunned buying new clothes in the mall, preferring to shop in thrift stores.

“One time, he found some overalls at Goodwill and they were something like $2 apiece,” said Mountain View Electric Association’s David Waldner, whom Rohr hired out of college in 1991.

“He bought 15 of them. He probably never wore any of them, but it was a good deal, so he bought them. You know, that was John. He was very cost-conscious to the point where you shook your head and said, ‘John, you’re the CEO of a company and you’re driving a Chevy Citation with a stick shift,’” said Waldner.

But when it came to Limon, a place he called home for more than half his life, Rohr spared no expense.

Though you’d never know it to look at him, Rohr was a lifelong investor who made millions in mutual funds. Twice married with no children, Rohr, 75, died in 2016 from heart surgery complications. Shortly before his death, he left most of his personal fortune to Limon—placing assets in a trust fund and directing that they go to Limon’s library, ambulance service and recreation and fire departments, as well as four other nonprofits.

Last September, the John Rohr Legacy Fund quietly made its first payouts of $600,000 to the eight entities.

“People were stunned that somebody would leave this kind of money to the community,” said Joe Martin, board president of Mountain View EA who, as Rohr’s personal representative, oversees the fund.

Martin, also NRECA’s Colorado director, wouldn’t divulge the fund’s worth. “I’ll just say millions” was his answer. But he did say the annual payouts could “go on in perpetuity” if the market continues to perform well.

The first investments “were distributed at about the average rate that the Standard & Poor’s 500 has returned over the last 25 years,” said Martin. “So if the stock market does a return of over seven and one-half to eight and one-half percent, we tell people it’s going to go on a long time.”

Rohr wanted the distributions to last as long as possible. “He knew that if he gave out so much a year, let the rest build back out, that they would give a lot more over time than giving them a one-shot million-dollar donation,” said Martin.

You could say Rohr lived—and died—by the cooperative values of integrity, innovation, accountability and commitment to community.

Rohr relocated to Colorado to lead Mountain View Electric Association in 1981, after spending three years at the helm of Washington Electric Co-op in East Montpelier, Vermont. Until his retirement in 1996, he made clear his philosophy about fiscal stewardship.

“John felt strongly about justifying every dollar spent, since it’s our member’s money,” said Waldner. “He also could recall every dollar we spent because he had an incredible memory for data and dates. He was the smartest person I ever met.”

While Rohr was private about finances, he was well-known in Limon.

“If somebody had a pancake fundraiser, he was there helping flip pancakes,” said Waldner, whom Rohr mentored. “He got me [involved] in the Rotary Club. If somebody asked for volunteer work, John was always there to do it.”

No one ever has bequeathed a gift of this size to Limon, said Town Manager Dave Stone. The largest recipient was the recreation department, which will use its $70,000 for ballfield improvements.

“We’re a rural community that hasn’t seen the economic growth that [the region’s] Front Range has seen. We could use the boost,” said Stone.

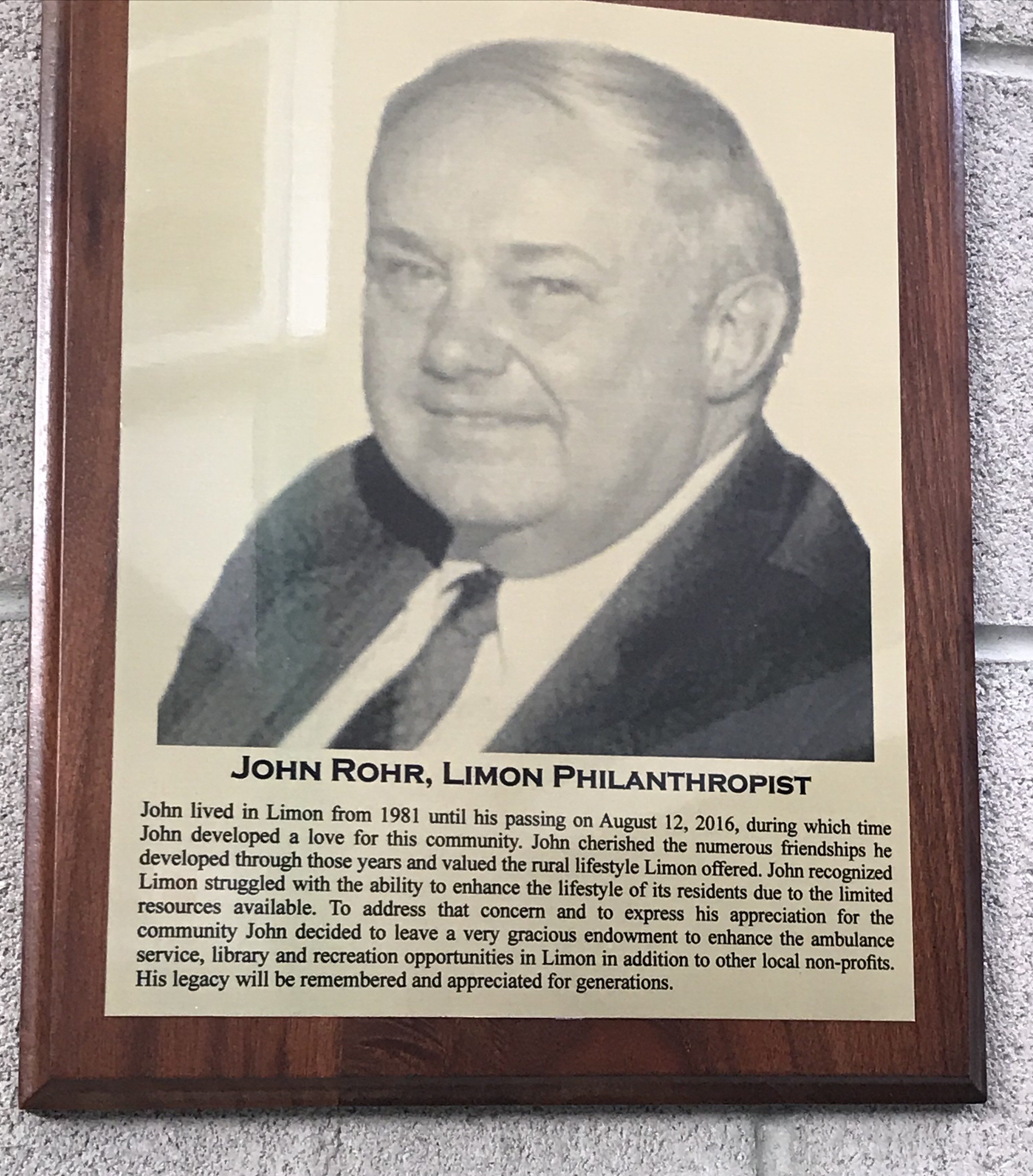

A plaque recognizes Rohr’s generosity in town hall. “He knew he was fortunate and that he led a good life and that he had a lot of money,” said Martin. “But he couldn’t part with it while he was alive. And that’s probably why one of the reasons he had a lot of it.”