No one likes overpaying, and electric cooperatives are no exception. Yet co-ops are spending much more than they should when it comes to insurance premiums for retirement pension plans.

“Because of the strength of our network, electric co-op retirement plans pose little risk of default. Yet we are required to pay insurance premiums as if we are a high-risk venture,” said NRECA CEO Jim Matheson. “When we overpay these premium costs, we take money away from our core mission as co-ops—member benefits and services.”

NRECA is pushing hard in the remaining weeks of Congress this year to bring down pension insurance costs. It joins more than two dozen other national organizations in urging Congress to pass the Retirement Enhancement and Savings Act (H.R. 5282 and S. 2526).

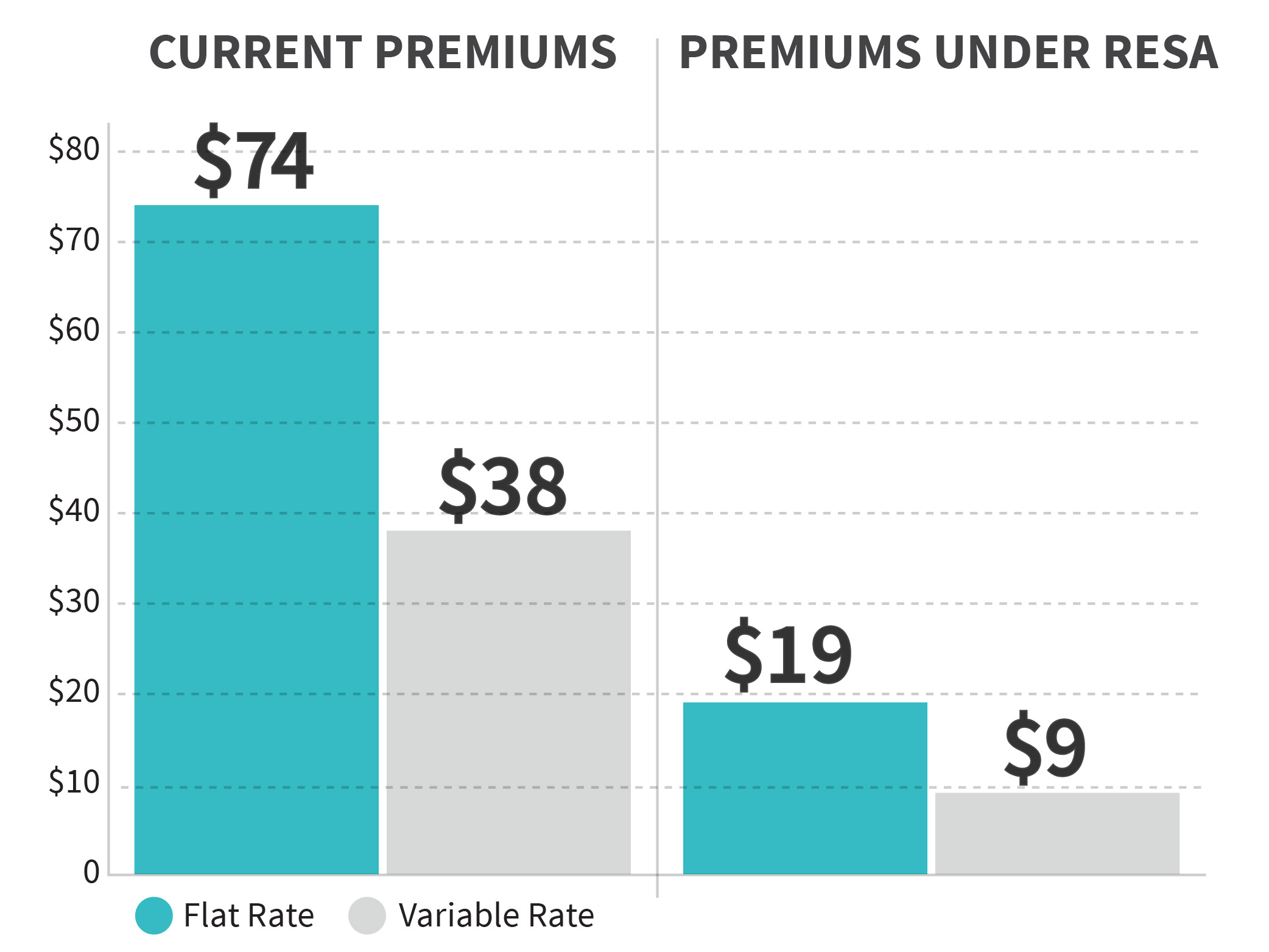

The legislation would reduce premiums paid by NRECA to the Pension Benefit Guaranty Corp. (PBGC) for the Retirement Security Plan by more than 80 percent. Senate Finance Committee Chairman Orrin Hatch, R-Utah, and ranking Democrat Ron Wyden of Oregon are among those who support the legislation.

How Congress Could Reduce Co-op Pension Plans

“There are heavy-hitters in our corner looking for a path forward,” said Christopher Stephen, NRECA senior legislative affairs director.

NRECA has been seeking to reduce these costs since 2006, when Congress changed the rules for all pension plans. Lawmakers in 2014 recognized that the retirement plans of NRECA and other rural co-ops and charity groups have significantly lower risk profiles than those of Fortune 500 companies and excluded them from volatile increases in required plan funding. But the formula determining PBGC insurance costs remained the same.

“Current PBGC rules are designed for large for-profit companies, not small, not-for-profit co-ops and charities. The legislation will address this inequity,” said Stephen.

The bill also addresses compliance issues for co-ops in the Retirement Security Plan or in their own plans that are closed to new employees while continuing benefits for current employees.

During the post-election lame duck session of Congress, NRECA is also urging lawmakers to resolve other issues important to co-ops. They include amending Section 118 of the 2017 tax law, which threatens co-ops’ tax-exempt status by counting government grants for rural development, broadband or storm recovery toward the non-member income limit of 15 percent.

NRECA also is advocating for strong rural development and broadband programs in a final compromise on a Farm Bill, before Congress adjourns for the year.

Cathy Cash is a staff writer for NRECA.